Richemont, the Swiss luxury goods group, announces its unaudited results for the six-month period ended 30 September 2005. These results are presented for the first time in compliance with International Financial Reporting Standards ('IFRS') rather than Swiss generally accepted accounting principles. The comparative figures presented here have been restated to reflect the IFRS reporting framework.

![]() Group sales increased by 16 per cent to ¤ 1 990 million, reflecting good growth across all markets.

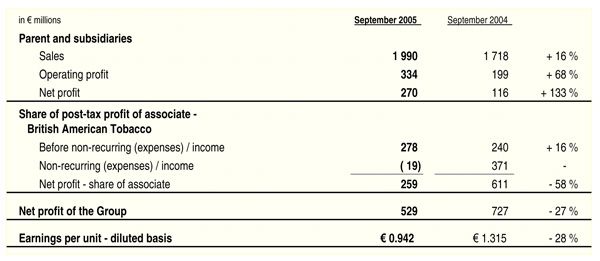

Group sales increased by 16 per cent to ¤ 1 990 million, reflecting good growth across all markets.

![]() Cartier, Van Cleef & Arpels, Montblanc and the Group’s specialist watchmakers all reported double-digit sales growth in the period.

Cartier, Van Cleef & Arpels, Montblanc and the Group’s specialist watchmakers all reported double-digit sales growth in the period.

![]() The growth in sales, linked to a controlled increase in operating expenses, resulted in operating profit from Richemont’s luxury goods businesses increasing by 68 per cent to ¤ 334 million. Excluding the gain of ¤ 11 million realised on the sale of Hackett, operating profit increased by 62 per cent to ¤ 323 million.

The growth in sales, linked to a controlled increase in operating expenses, resulted in operating profit from Richemont’s luxury goods businesses increasing by 68 per cent to ¤ 334 million. Excluding the gain of ¤ 11 million realised on the sale of Hackett, operating profit increased by 62 per cent to ¤ 323 million.

![]() Net profit from the parent and subsidiaries increased by 133 per cent to ¤ 270 million.

Net profit from the parent and subsidiaries increased by 133 per cent to ¤ 270 million.

![]() The Group’s share of the post-tax profit of its associated company, British American Tobacco, excluding the impact of non-recurring items from both periods, increased by 16 per cent to ¤ 278 million. In the 2004 comparative period the Group’s share of non-recurring items reported by BAT amounted to ¤ 371 million. This stemmed largely from the gain arising on the merger of BAT’s US business with that of R.J. Reynolds. Including such items in both periods, the Group’s share of BAT’s earnings fell by 58 per cent to ¤.259 million.

The Group’s share of the post-tax profit of its associated company, British American Tobacco, excluding the impact of non-recurring items from both periods, increased by 16 per cent to ¤ 278 million. In the 2004 comparative period the Group’s share of non-recurring items reported by BAT amounted to ¤ 371 million. This stemmed largely from the gain arising on the merger of BAT’s US business with that of R.J. Reynolds. Including such items in both periods, the Group’s share of BAT’s earnings fell by 58 per cent to ¤.259 million.

![]() Excluding the gain realised on the sale of Hackett, net profit of the Group, including the contribution from British American Tobacco before nonrecurring items, increased by 51 per cent to ¤ 537 million. However, taking into account the ¤ 11 million gain and the impact of non-recurring items reported by BAT in both periods, net profit of the Group declined by 27 per cent to ¤ 529 million.

Excluding the gain realised on the sale of Hackett, net profit of the Group, including the contribution from British American Tobacco before nonrecurring items, increased by 51 per cent to ¤ 537 million. However, taking into account the ¤ 11 million gain and the impact of non-recurring items reported by BAT in both periods, net profit of the Group declined by 27 per cent to ¤ 529 million.

![]() Earnings per unit on a diluted basis decreased by 28 per cent. Excluding the impact of non-recurring items in both periods, earnings per unit on a diluted basis increased by 48 per cent from ¤ 0.644 to ¤ 0.956.

Earnings per unit on a diluted basis decreased by 28 per cent. Excluding the impact of non-recurring items in both periods, earnings per unit on a diluted basis increased by 48 per cent from ¤ 0.644 to ¤ 0.956.

![]() Cash generated by operations was ¤ 175 million for the six-month period. Net cash at 30 September 2005, after payment of the ordinary and special dividends of ¤ 553 million, amounted to ¤ 384 million.

Cash generated by operations was ¤ 175 million for the six-month period. Net cash at 30 September 2005, after payment of the ordinary and special dividends of ¤ 553 million, amounted to ¤ 384 million.

Executive Chairman’s commentary

The results for the six-month period to 30 September show strong growth in sales and a significant increase in operating profit from Richemont’s luxury goods operations. The Maisons have performed well.

Sales in the period increased by 16 per cent and operating profit grew by 68 per cent. Eliminating the one-off gain on the disposal of Hackett, which is included in the operating profit figure, growth was 62 per cent compared to the same period of last year.

Whilst the Americas have shown the strongest growth in the period at 21 per cent, the Group has seen 18 per cent sales growth in the Asia-Pacific region and 14 per cent in Europe. In Japan, where the signs are that the deflationary cycle may finally be coming to an end, sales increased by 11 per cent.

Cartier has enjoyed sustained growth in all of its markets with particularly good growth in terms of high jewellery. In Japan, which remains a very important market for Cartier, sales grew by 13 per cent in the period.

Van Cleef & Arpels is growing and is establishing itself as a leader in terms of design and exclusivity at the very top end of the market.

It is pleasing to see the Group’s specialist watchmakers all report strong sales growth. Vacheron Constantin, in its 250th anniversary year, has performed particularly well, although all of the watch businesses have enjoyed very good growth, as evidenced by the 23 per cent increase in sales in the period.

Montblanc also experienced very good growth in its watch and leather goods ranges during the six months. Whilst firmly rooted in its writing instrument heritage, Montblanc has very successfully extended its reach into other product lines – a tribute to the strength of the brand.

Alfred Dunhill’s sales increased by 4 per cent overall. Excellent growth in the Asia Pacific region and in the smaller North American market was offset by disappointing sales figures in Europe and Japan. To some extent, these were due to supply difficulties in particular product areas. However, in leather products, the new product lines introduced over the last year have generated good demand.

Lancel has reported growth in sales of 11 per cent for the half year. Given that its business is focused in the French domestic market, this is an encouraging performance and supports our view that, with the right product mix, Lancel can flourish.

In terms of our other businesses, I would like to mention specifically Chloé. This business has outperformed its peers, more than doubling its sales in the six-month period under review. With a unique design positioning, strong management and Richemont’s backing, Chloé is developing its wholesale business and rolling out its international retail expansion programme.

British American Tobacco

Richemont’s investment in BAT continues to perform well. Excluding the large non-recurring items reported by BAT in the prior year, our share of BAT’s profits increased by 16 per cent and, in cash terms, Richemont received dividend income of ¤ 247 million. BAT is a truly global business which is well managed with the clear objective of maximising profitability and shareholder value.

Transition to International Financial Reporting Standards (‘IFRS’)

Richemont has fully implemented IFRS in the preparation of these interim financial statements for the period ended 30 September 2005, having previously reported under Swiss generally accepted accounting principles. It is worth noting that, despite the complexities of IFRS, which will result in more volatility from year to year in the Group’s results, we do not anticipate any significant changes to the Group’s business plan as a result of this accounting change.

The principal change stemming from the move to IFRS is that Richemont no longer amortises goodwill relating to the investment in British American Tobacco. Although we have always fully hedged stock option awards to employees, the Group must also apply the new provisions of the international standards which require the expensing of stock options. In this respect, operating profit for the six months under review includes a notional charge of ¤ 17 million (2004: ¤ 16 million) in respect of options granted to employees.

Full details of the impact of IFRS on the 2005 financial statements, which we have restated to reflect the new rules, can be found on the Richemont website at www.richemont.com/investorinfo/interimÐ2005.php

Richemont is also required to provide extensive supplementary information in this year’s interim report, as it is the first to be presented in accordance with IFRS. Rather than include the financial statements in their entirety here, these can be downloaded from the Group’s website and will be mailed to unitholders upon request.

Outlook

The performance of the first six months points to a strong year for Richemont. Although sales in October showed a slowdown in the rate of growth, they were 10 per cent above the prior year at historic rates. Asia- Pacific, the Americas and Japan all reported double digit growth during the month. Sales in Europe, however, were flat compared to October 2004, Cartier having recorded certain exceptional high-jewellery sales in Paris during that month.

I am confident that - in the absence of any external events outside our control - Richemont’s luxury businesses will report good growth in terms of sales and operating profit for the year as a whole.

Source : Compagnie Financière Richemont SA

www.richemont.com

Contact : [email protected]

(Please credit europastar.com)